Partnerships between entrepreneurs and organizations such as manufacturers, system integrators, or vertically integrated entities can catalyze the commercialization process and are key for early-stage technology developers or entrepreneurs bringing their new innovations to the marketplace. Engaging with other organizations can give an entrepreneur—whether they are at a research institute, university, or startup—access to capabilities, expertise, and markets that cannot be cultivated in-house. However, identifying and evaluating potential partners can be a difficult mission.

Steps to Identify and Evaluate Technology Commercialization Partners

To aid our client, an international research institute focused on climate-relevant technologies, in completing this mission, we leveraged our established steps for helping entrepreneurs identify the right commercialization partner that could help our client enter the US market. Using the below steps, we identified, screened, and facilitated initial conversations with possible partners, leading to at least one site visit between our client and the prospective partner.

1. Conduct candid self-evaluation to define your commercialization strategy

First, we helped our client conduct a candid self-evaluation, through which they sought to understand how their technology compares to and is differentiated from the state of the art, as well as what their key needs are from a commercialization partner.

2. Determine where on the value chain the ideal partner exists

Before identifying potential partners, an entrepreneur must understand their industry, including the contributing stakeholders, and where along the value chain does their ideal partner(s) lie (e.g., they may be a materials provider, distributor, or manufacturer among others). There are two key considerations for this exercise: 1) the entrepreneur may require multiple partners along the value chain (e.g., both a co-developer and a contract manufacturer), and 2) one must understand (and plan for) their partnership needs both today and tomorrow as the future needs will impact the desired partnership structures.

Our client was interested in entering an unfamiliar market with an early-stage technology. Alongside our client, we developed a value chain for the industry and located the positions of potential partners, of which there were two distinct positions, providing a starting point for the partner identification step.

3. Identify potential partners at the proper value chain position

After understanding the value chain position(s) of the ideal partner(s), entrepreneurs should develop an extensive list of organizations that may fit their partnership needs. This list should capture anyone that could be a potential partner and will be filtered subsequently.

Using this process, we identified over 100 potential partners for our client. Using their feedback, we screened these companies by type (startup, established organization, or manufacturer), geography, technology development stage, partnership history, and their public strategy among other characteristics. The list of potential partners gave our clients material to think deeper about who they wished to partner with.

4. Determine what kind of partner they may be

It is important to understand what type of partner an organization may be. We help our clients understand what motivations, biases, strategies, and past experiences a partner may bring to a partnership discussion. This information may include knowledge that an organization’s business model relies on incorporating external innovations or companies through acquisition or that a company regularly engages in strategic partnerships. The background and context can help an entrepreneur prioritize outreach (see Step 5), filter interested parties, and better understand how they wish to work alongside a partner.

It is helpful to build partner archetypes based on publicly available information (and that gathered during outreach) regarding a potential partner’s strategy, hiring tendencies, technical development and R&D, or acquisition inclinations. This information can be filtered and understood through theoretical frameworks like those we developed for our client.

Inspired by the Roger’s Adoption Curve, we generalize commercialization partners into three categories: Innovators, Market Entrants, and Late Majority:

- Innovators regularly introduce new products using ample development or co-development resources and have a high-risk tolerance.

- Market Entrants may seek to use an early-stage technology (or intellectual property, IP) as their ticket to a new market.

- Late Majority companies will be the "first to be second." They may be interested in engaging with entrepreneurs only when there is a clear demand for the innovation.

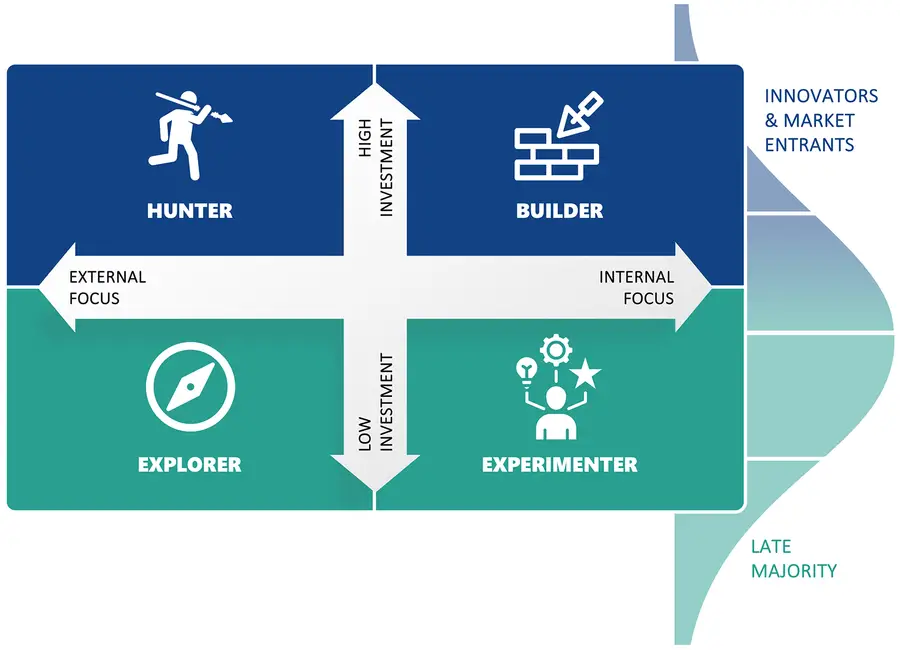

The Innovation Matrix places organizations on a grid balancing External vs Internal Focus on innovation and the level of investment in innovation, defining the four types – Hunters, Builders, Explorers, and Experimenters.

Overlaying these Partner Archetypes with the Innovation Matrix, a framework for understanding how companies approach innovation, one can build profiles of ideal partners (figure above). Determining which partner archetype to target will depend on the goals of the entrepreneur.

5. Reach out to potential partners, talk to people

Reaching out to potential partners either through email, LinkedIn, or at technical conferences is a crucial step of developing a commercialization partnership, providing entrepreneurs insight into how the market views the early-stage technology, the motivations of the companies, and the companies’ appetite for partnerships.

To support our client’s partnering efforts, RTI Innovation Advisors reached out to nearly 40 organizations, interviewing over 10 and nearly half were interested in continuing partnership discussions with our client. These leads resulted in site visits by our client to potential partners and continued meetings.

6. Evaluate the interested parties for strategic fit and alignment

When those interested entities have been engaged, a last down-selection is needed based on how those organizations fit with the partnership needs, considering the archetype of the potential partner, their motivations, their business model, and the benefits the partner-seeker may receive from a partnership.

It is imperative to be critical of potential partners, specifically regarding what they are bringing to the table and what their motivations may be. Being critical can help an entrepreneur avoid engaging with a flashy brand name that may not be as invested in a mutually beneficial relationship as well as ensure alignment on risk appetite and goals, ensuring a durable, long-term collaboration.

The market and technology analysis, interview feedback, and partnering frameworks we developed for our client gave them the tools to effectively evaluate what kind of organizations they would ideally partner with and an understanding of the associated risks. We used the frameworks above to understand the archetype of the ideal partner and categorize where both the interested and uninterested parties fall. The analysis enabled our client to visualize the gap between their ideal partner and what kind of organizations expressed interest in partnering.

7. Execute a technology commercialization partnership

At the point when mutual interest has been generated and both parties want to move towards a partnership, that agreement must be executed. A partnership can take many forms that range in requirements from either party including, for example, a memorandum of understanding (MOU), strategic alliance, joint venture, or licensing agreement. At this stage, IP and agreement terms can be leveraged to ensure there is a balance between risk and reward when entering a partnership.

Conclusion: Moving forward with technology commercialization partnerships

Between the feedback garnered during the interviews of potential partners, the recommendations we provided on continued partnership efforts, and the frameworks we developed for evaluating partners, our client has a much clearer direction for seeking partnerships and developing their early-stage technology, so it will be more likely licensed or commercialized in their target geography.

Learn more about how the Innovation Advisors team can help you understand and implement partnering strategies and technology-to-market efforts for your early-stage innovations.